Secure Crops. Secure Futures.

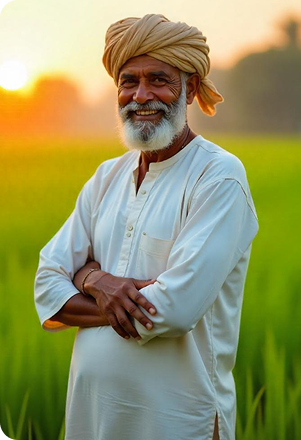

Protecting Farmers from Climate Uncertainty with Smart Insurance Solutions

With unpredictable climate events, our Crop Insurance platform empowers both farmers and insurers through

satellite-based field monitoring and advanced weather analytics. Backed by real-time data and AI insights, we

help reduce financial losses, ensure claim accuracy, and bring stability to agricultural livelihoods.

Introduction to Crop Insurance

Minimizing Risk,

Maximizing Resilience!

Our AI-powered platform equips farmers and insurers to make smarter decisions by leveraging satellite imagery, weather trends, and field data. From risk assessment to claim validation, we close the information gap, enabling a proactive response to weather-related crop damages and loss scenarios. By improving transparency and reducing disputes, we help build lasting trust in rural finance systems.

Solving Agri-Insurance Challenges

Bridging the Gaps in

Traditional Crop Insurance

Pain Points

- Fraud risks and false claims due to lack of on-ground verification.

- Insufficient information for accurate risk assessment.

- Time-consuming and inconsistent field scouting methods.

- Challenges due to Inaccurate or delayed loss assessments.

- Lack of historical and background data for decision-making.

- Inadequate data to support reliable index-based insurance.

Solutions

- Real-time credit risk mitigation using crop health indices.

- Harvest monitoring via remote sensing.

- Satellite-based crop damage detection with historical comparisons.

- ROI-focused decision-making using seasonal forecasts.

- Productivity insights for rental, input, and subsidy planning.

- Smart insurance modeling for both indemnity and index-based policies.

Why Choose Us?

Advantages of Our Crop-Insurance Solutions

We transform outdated claim systems into intelligent, responsive solutions that benefit both farmers and

insurers. From accurate risk assessment to data-driven decision-making, our tools are designed to simplify

insurance workflows while maximizing protection.

Enable field-level visibility through satellite-based vegetation indices & weather data, improving precision in claim verification & crop monitoring.

Offer dynamic risk modeling using real-time and historical weather insights to anticipate and mitigate losses before they escalate.

Use geospatial mapping to identify damage-prone areas and tailor insurance coverage accordingly, boosting insurer credibility.

Streamline the entire insurance

lifecycle—assessment, documents, and claims—with digital verification tools and survey apps.

Minimize fraud and error by

integrating verified farm and

farmer data into the insurance

ecosystem.

Support both indemnity-based &

index-based insurance policies,

offering flexible options to meet

varied farming needs.

Let’s Build a Resilient Farming Future!

Every field has a story. Every farmer deserves security. Join hands with Falcon Info Solutions to bring data-backed clarity, transparency, and assurance to agricultural insurance. Whether you’re an insurer, policymaker, or agri-tech startup, our tools are built to scale with your mission.